The crypto market suddenly re-energized after 14 years of “hibernation” two old Bitcoin wallets holding 20,000 BTC.

The event not only attracted attention due to the great value involved, but also sparked speculation about its meaning and its impact on the market.

Doormant $2 billion Bitcoin moves, as the market estimates

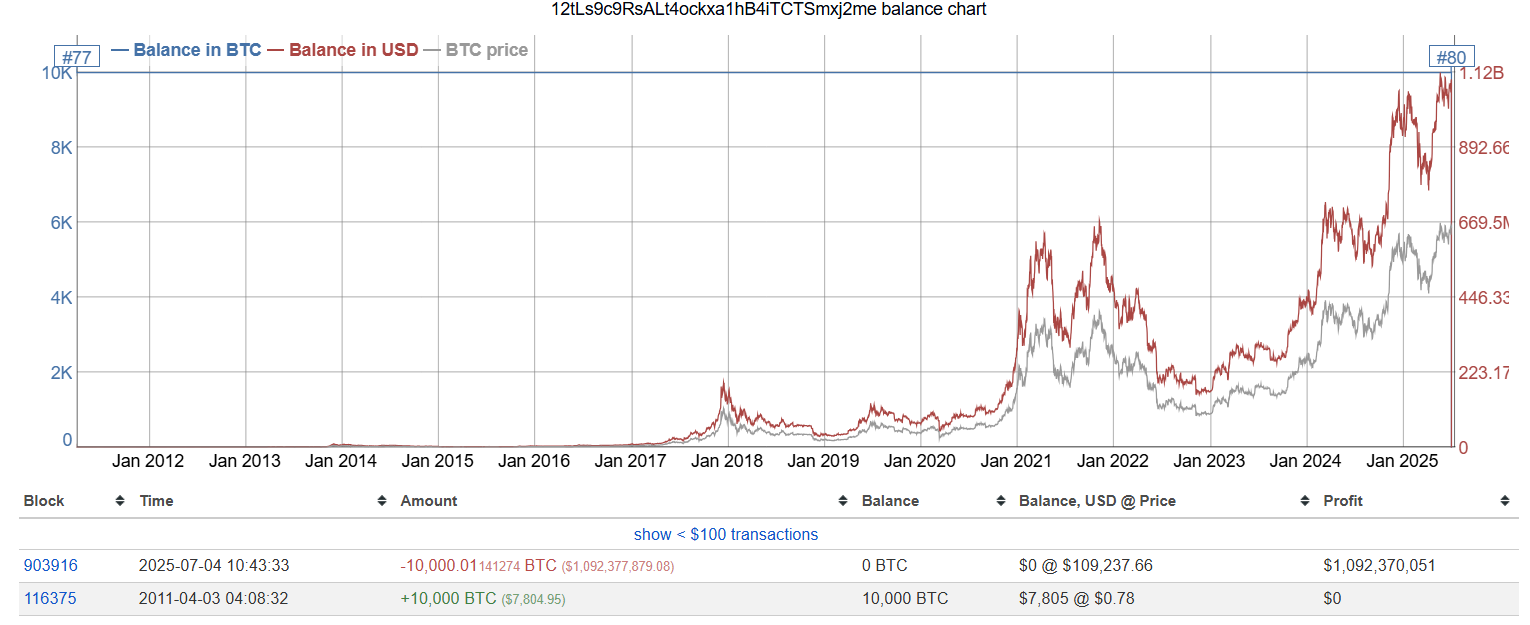

According to LookonChain, one of these wallets was created on April 3, 2011, when Bitcoin was priced at just $0.78. At the time, the owner bought 10,000 BTC for a total cost of less than $7,805.

The wallet has not been active for over a decade. Then, early on July 4, 2025, the entire BTC balance moved.

On the same day, Lookonchain also detected another wallet that had held 10,000 BTC since 2011, making a similar move.

These two wallets held a total of 20,000 BTC, totaling over $2 billion, and transferred all Bitcoin to new addresses. This kind of movement is rare in wallets during the “Satoshi era” and refers to the earliest Bitcoin period in which Nakamoto At was active. These wallets used the legacy format, which was common at the time, but are rarely used today.

The 20,000 btc relocation saw Bitcoin hover near record highs, at around $110,000 per coin. This added more intrigue to the potential motives of the owner.

Some users of X have suggested that this could be a sign that early investors (OG Hoddlers) will ultimately decide to cash out after holding for more than a decade. After all, Bitcoin prices have skyrocketed hundreds of thousands of times compared to when they first bought them.

“From $7,805 to $1.09 billion… that’s the best investment decision of the century…” X Account Crypto Alpha said.

Other theories have emerged, including the concept that the wallet may have been infringed, but there is no concrete evidence. Owners can also move Bitcoin to a new wallet for better security or prepare for future transactions.

Whatever the reason, Bitcoin prices remained relatively stable on July 4th, hovering around $109,000 without any major fluctuations.

Bitcoin Coin Day destroyed metric rise in the second quarter

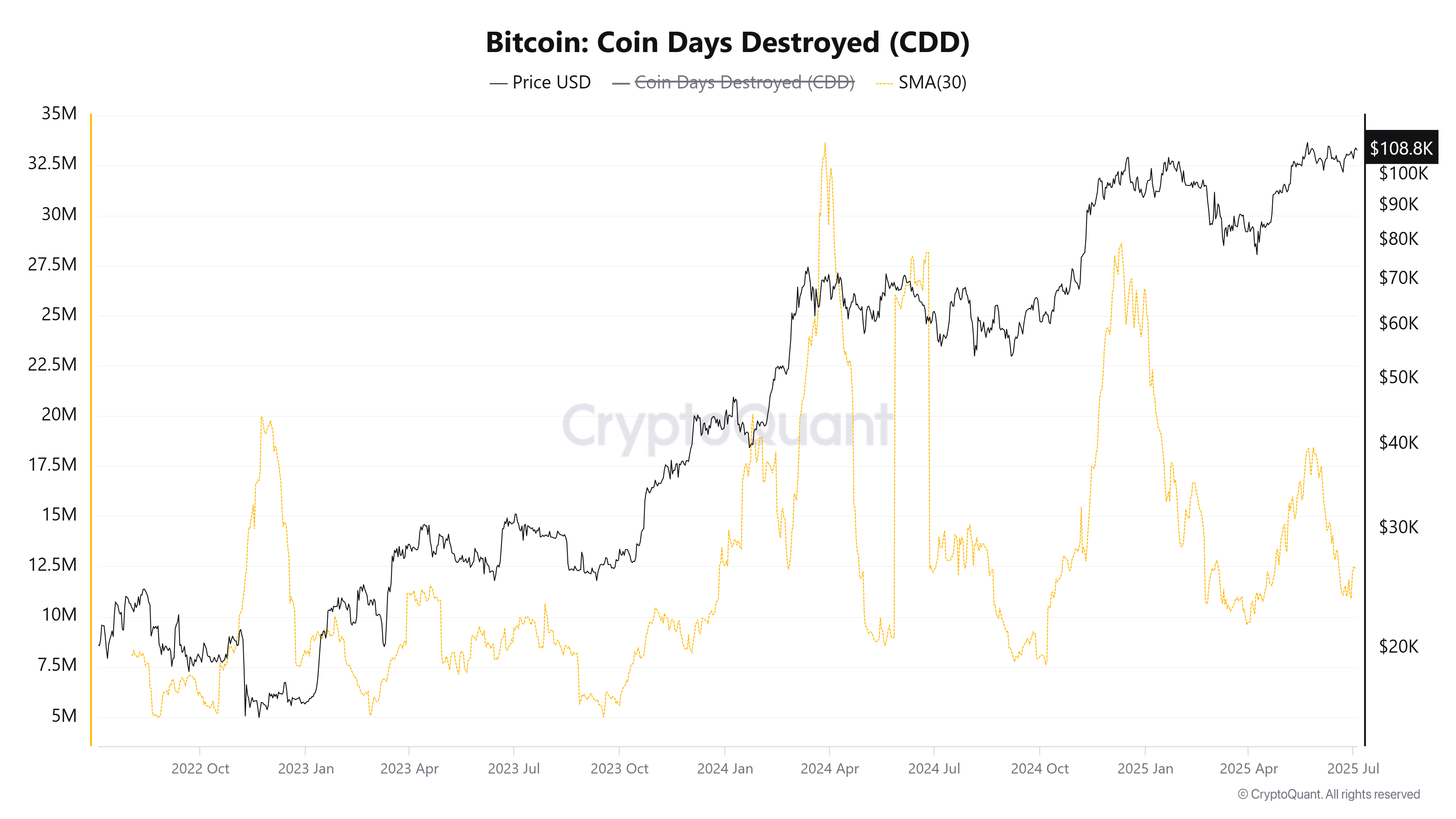

Coin Days Destroy (CDD) is an on-chain metric that measures the true level of activity in Bitcoin. We’ll look at the period when the coin remains “dormant” before it is spent.

A high CDD means that many “old” coins (with many accumulated coin days) are being moved.

Data from Cryptoquant shows that CDDs rose from 10 million to 17.5 million in early July before returning to 11 million.

This can have a major negative impact on the price if your long-term Bitcoin Zilla wallet becomes active and your CDD rises sharply.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.