Public companies are taking a more positive attitude towards Bitcoin (BTC) than the highly celebrated Exchange Sales Fund (ETF). In the third consecutive quarter, they acquired more BTC in the second quarter of 2025 than ETFs.

This trend shows wider strategic changes among the Ministry of Corporate Treasury to adopt Bitcoin as a balance sheet asset.

Corporate Treasury is leading the accumulation of Bitcoin

Just a month ago, Beincrypto reported that over 60 companies were following MicroStrategy’s Bitcoin Playbook, with the report ahead of the second quarter (Q2) deadline.

Based on the latest findings, public companies continue to support micro-Strategy Playbooks and gradually mainstream their strategies in a crypto-friendly US regulatory environment.

According to Bitcoin’s Treasury data, the public company increased its BTC holdings by about 18% in the second quarter, adding around 131,000 BTC.

By comparison, despite its popularity since the approval wave of the US Bitcoin ETF in January 2024, exchange trade funds expanded their holdings of 8% or around 111,000 BTC over the same period.

This trend indicates clear differences in buyers’ behavior. ETFs usually serve investors seeking price exposure to Bitcoin through regulated financial products, but public companies Get it BTC has a long-term strategic mindset.

They aim to increase shareholder value by holding BTC as a reserve asset or by being exposed to many of the digital gold.

This change is particularly important in the context of US policy. Since President Donald Trump’s reelection, the regulatory environment has changed in favour of the crypto industry.

In March, Trump signed an executive order to establish a US Bitcoin Reserve. This iconic but powerful move has eliminated many of the reputational risks associated with a company’s BTC holdings.

The last time the ETF outperformed the company in BTC acquisition was in the third quarter of 2024, before Trump took office.

New corporate entrants show wider adoption of Bitcoin financial strategies

This Q2 surge included several famous moves, including GameStop. The electronic company was once at the heart of a frenzy of retail trading and began accumulating BTC after it was approved as a Treasury protected asset in March.

Similarly, healthcare company KindlyMD merged with Nakamoto, a Bitcoin investment company founded by David Bailey of Crypto Advocate.

Meanwhile, Anthony Pompliano’s new investment vehicle, Procap has announced its own BTC accumulation strategy while preparing to be published via SPAC.

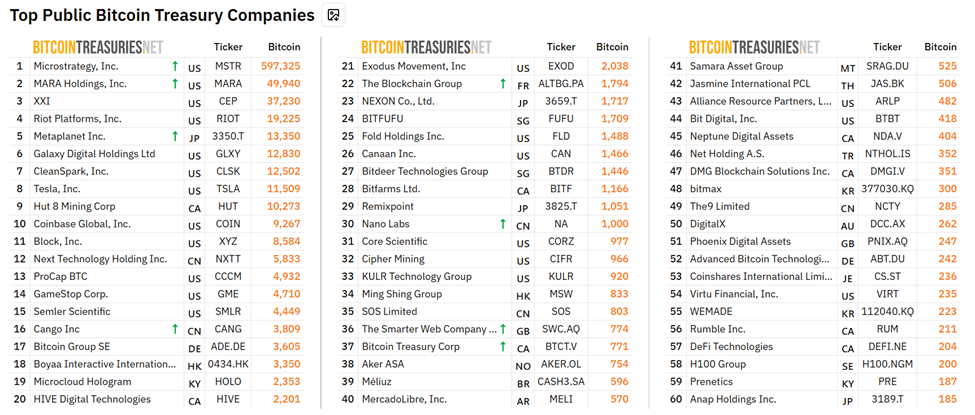

Nevertheless, the strategy (previously micro-strategic) remains an uncontroversial leader in the corporate Bitcoin race, with 597,325 BTC under its control. Mala Holdings follows, holding 49,940 coins.

Currently, public companies have around 855,000 BTC, with 21 million people taking approximately 4% of the fixed supply limit for Bitcoin.

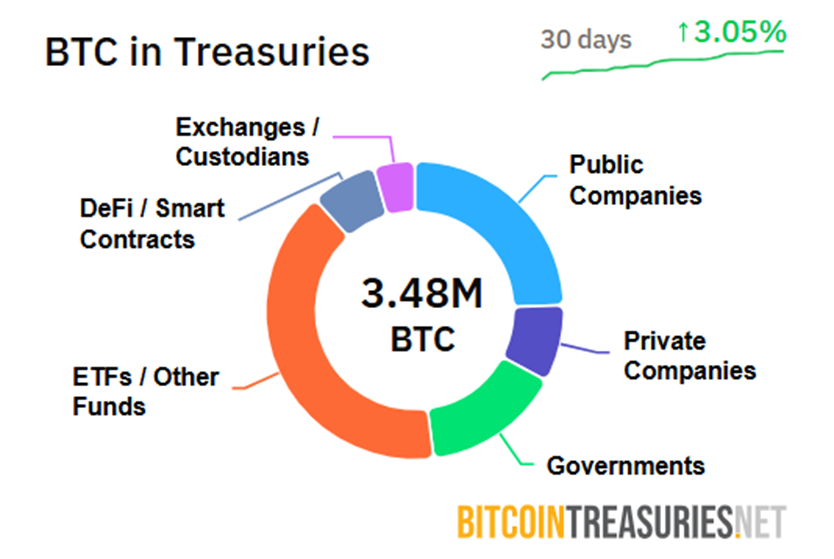

ETFs still hold more in absolute terms (about 1.4 million BTC or 6.8%), but the company has been buying momentum in recent quarters.

The long-term sustainability of the corporate Bitcoin Rush is controversial, but the short-term momentum is unmistakable.

As Bitcoin becomes more normalized, traditional institutional investors can bypass proxies such as ETFs and Treasury, and ultimately get direct exposure through regulated channels. Still, corporate finances are serving as a powerful new mechanism to drive Bitcoin forward.

Correcting the regulatory environment and the stock market provide new ways to access capital, so businesses are leveraging not only hedging but outperform balance sheets.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.