Bitcoin investment can be as simple or complicated as your choice. However, by utilizing some free and powerful metrics, investors can gain a significant advantage over the average market participants. These tools are available for free and simplify on-chain analysis and help remove emotional decisions.

Cap-Follow Wave

The realized cap HODL Waves metric is one of the more subtle tools in the on-chain toolbox. Analyze realize prices, which are the average cost-based basis of all Bitcoin held on the network, and break them down by age band. A set of a fairly old band is a coin held within three months. Dominating the realised cap by this segment shows a new flood of capital entering markets that are normally driven by retail FOMOs. The historic peaks of these young holdings, often shown in warm colors on the charts, coincides with the tops of major markets such as late 2017 and 2021.

Conversely, when the impact of short-term holders is low, they generally match the bare market bottom. These are periods where there are few new buyers in, emotional darkness and prices are deeply discounted. This metric visually strengthens the opposite strategy and can be purchased when others sell when they are scared and greed controls.

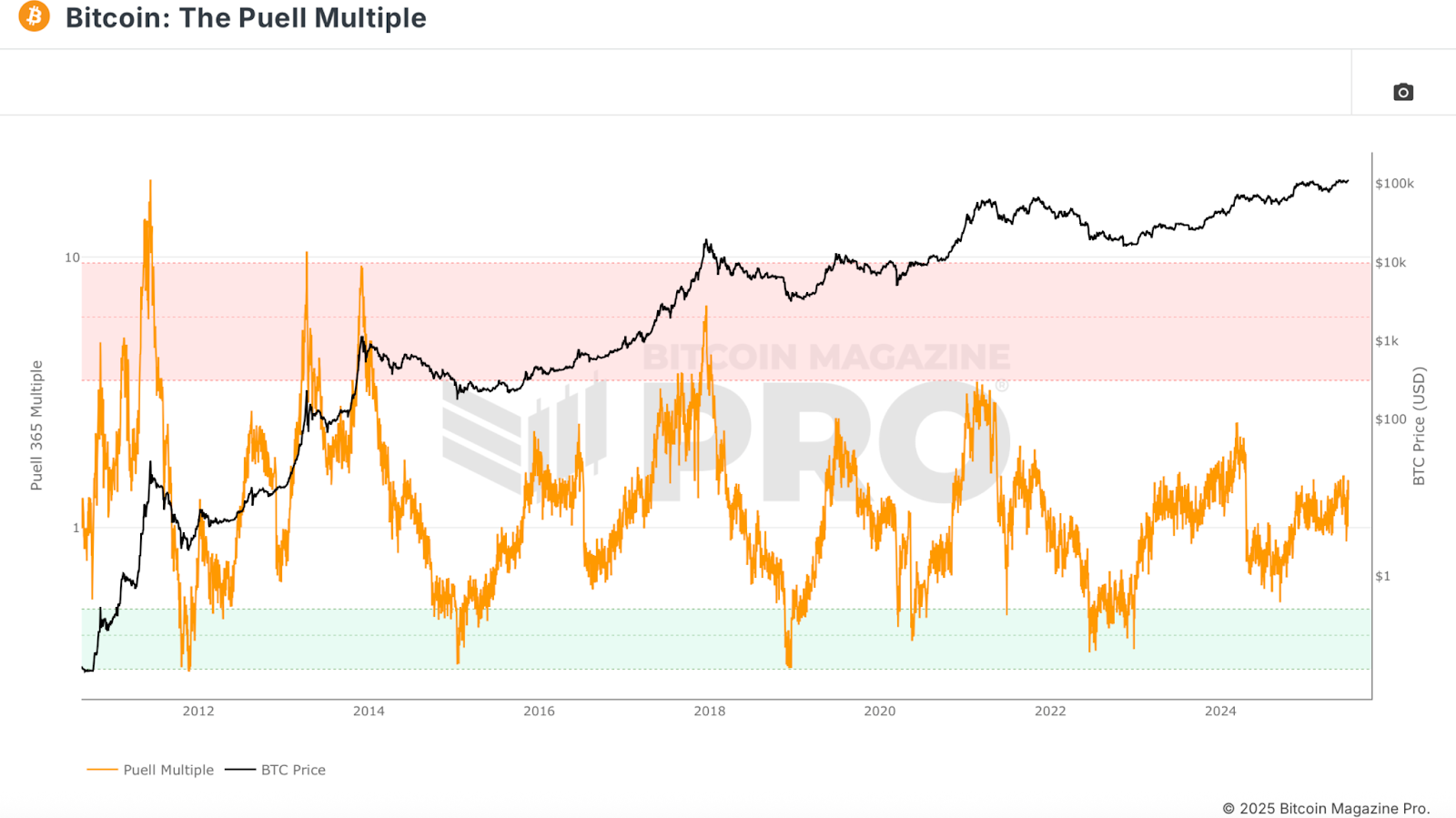

Puer times

Puell Multithip helps to assess miners’ feelings by comparing current daily revenue (USD) with block compensation and fees against a yearly average. High values indicate that miners are highly profitable, while lower values indicate distress and potentially signaling underestimation.

During the previous cycle, low Puer multiples were a great opportunity for accumulation, as it coincides with a time when even miners struggle to maintain profitability, even at high costs and operational risks. This serves as an entry signal for economical floors and high confidence.

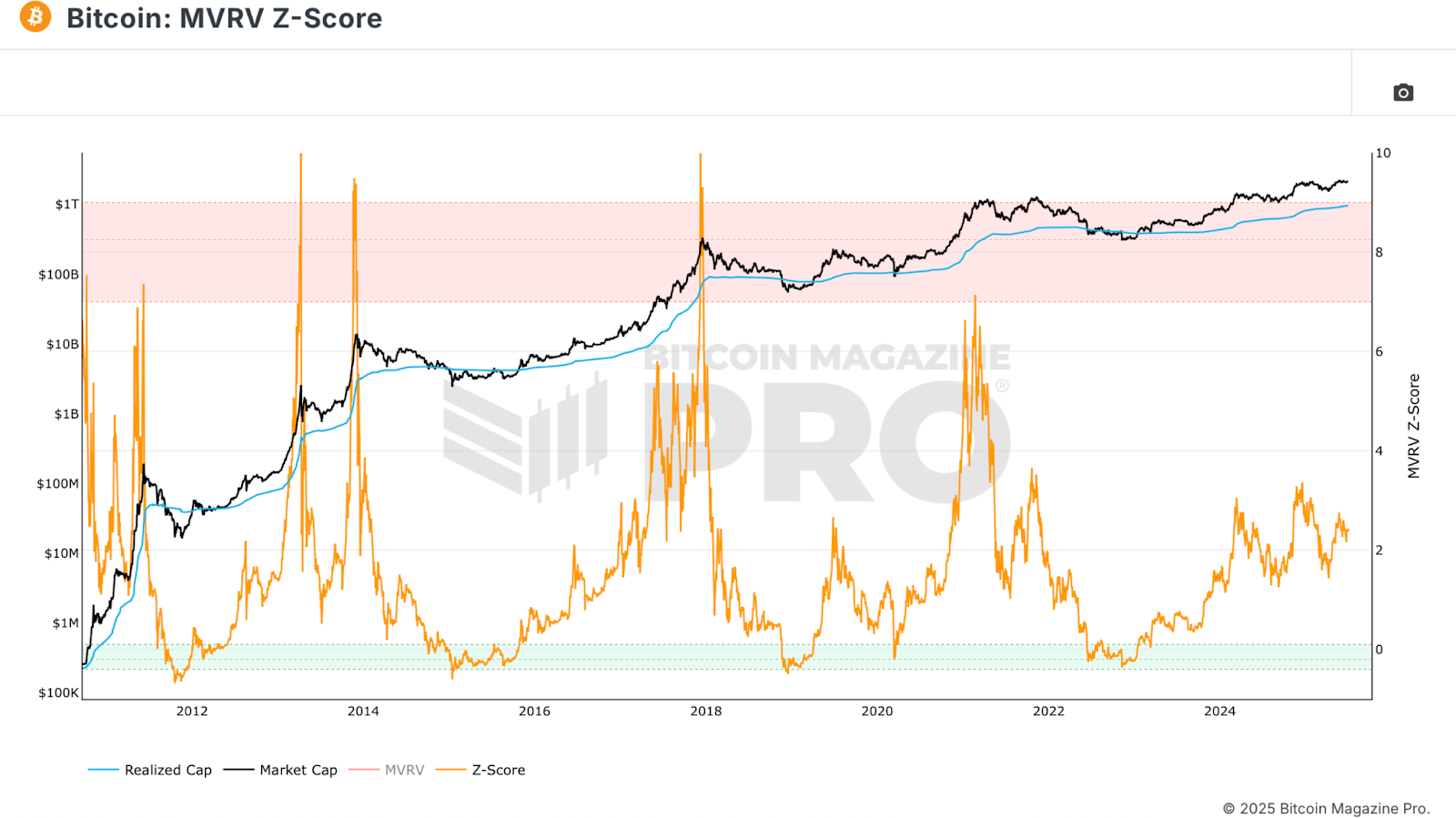

MVRV Z Score

The MVRV Z-score is perhaps the most widely recognized metric in the Chain Armory. Standardize the ratio of market value (current price multiplied by circular supply) and realised value (average cost-based or realised price) and normalize it across the unstable history of Bitcoin. This Z-score identifies extreme market conditions and provides a clear signal for the top and bottom.

Historically, a Z-score above 7 indicates the euphoric market situation ripe for the local top. Z-scores below zero often coincide with the most attractive accumulation period. Like any other metric, do not use it alone. This metric is very effective when combined with some of the other discussed in this analysis for confluence.

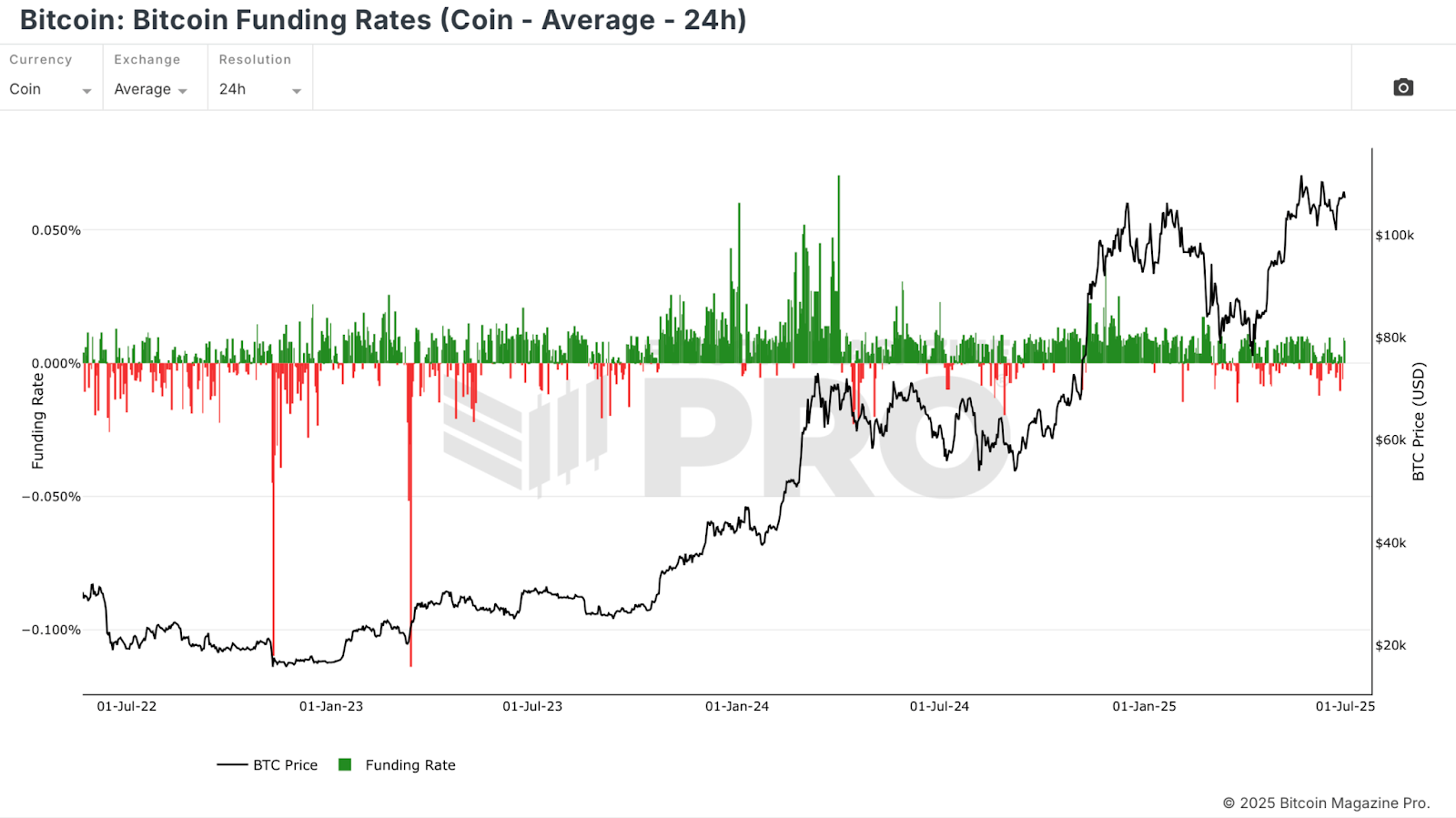

Funding rate

Bitcoin’s funding rate reveals the sentiment of leveraged futures traders. Positive funding means that Long is paying for shorts, suggesting bullish bias. Very high funds often coincide with euphoria and precede the revision. Conversely, negative funding can show fear and precede a sharp gathering.

Traders are putting BTC directly at risk, so the funding rates that coins have removed provide a more pure signal than the USD pair. Spikes in either direction often show the opposite opportunity, warning that high speeds will overheat and low or negative rates are suggested at the bottom.

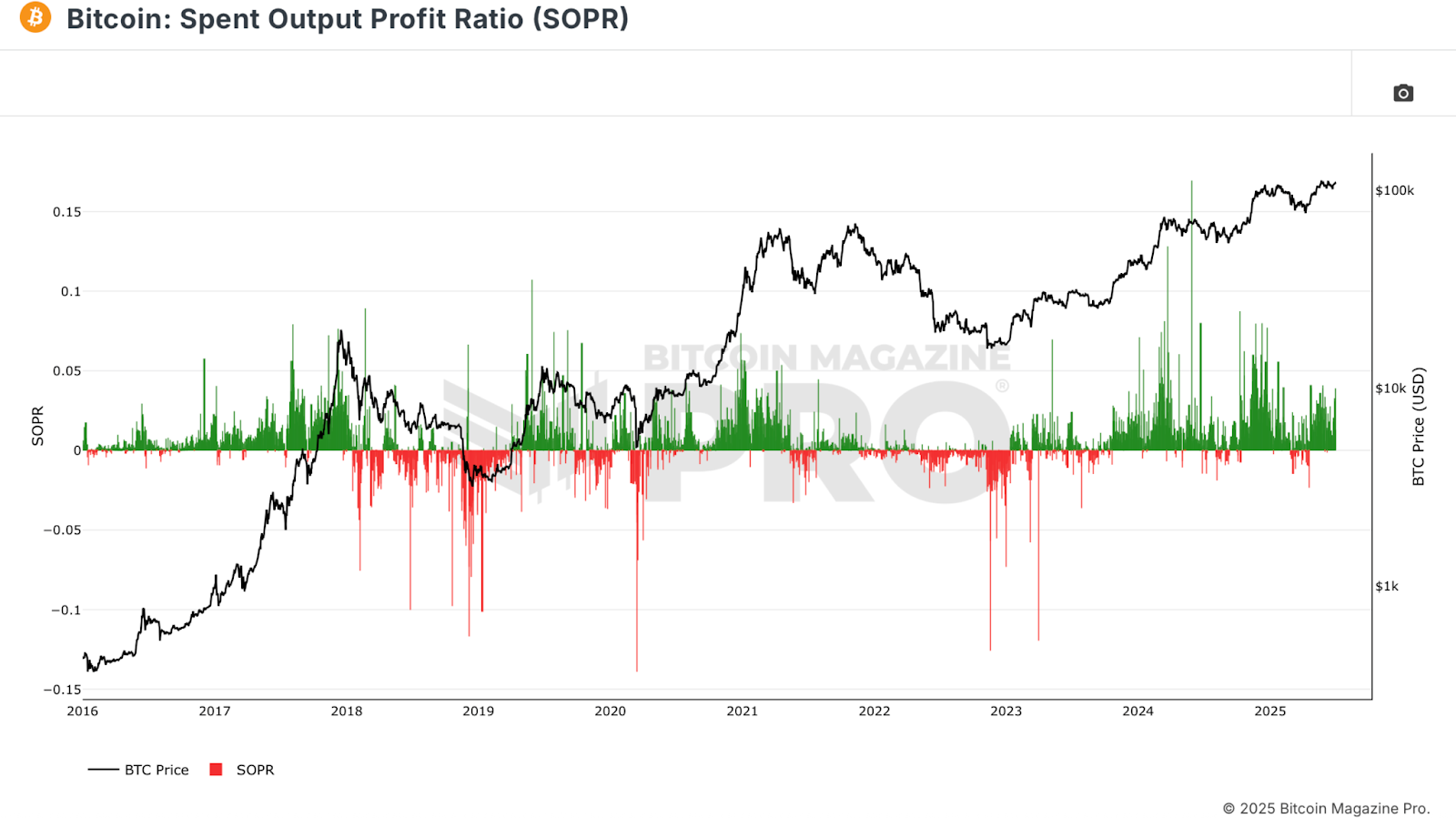

sopr

Used Output Profit Rate (SOPR) tracks whether a coin has moved on-chain. A read above zero means that the average coin moved has been sold with profit. Below zero suggests realised losses.

A sharp downward spike indicates surrender and investors are trapped in losses. These often mark fear-inducing sales and major purchase opportunities. Sustained measurements of SOPR above zero can indicate an upward trend, while excessive profit acquisitions can indicate an overheated market.

Conclusion

By layering these metrics, investors gain a multidimensional view of the situation in the Bitcoin market by layering CAP HODL Waves, Puell Multithip, MVRV Z-Score, funding rates, and SOPR. A single indicator does not provide all the answers, but joining between several improves the probability of success. Whether you’re accumulating in the bear market or distributing it near potential tops, these free tools can help you remove emotions and follow your data to dramatically improve the edge of the Bitcoin market.

💡 Did you love the price dynamics of Bitcoin on this deep dive? For more expert market insights and analysis, subscribe to Bitcoin Magazine Pro on YouTube!

For more in-depth research, technical metrics, real-time market alerts, and access to expert analytics, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making an investment decision.

Source: https://bitcoinmagazine.com/markets/5-free-metrics-bitcoin-investor